RAR

Revenue-at-risk

When I took one of my first accounting classes I was fascinated with the story that balance sheets told you. For instance, Target makes millions in gift cards every year. According to their 2019 10-K Filing it was approximately $645 Million in 2019. However, they can’t report any of that revenue until the gift cards are actually used. If they are never used, they never see the revenue. That money actually sits in the balance sheet as a liability, because it’s money that hasn't been earned. Once they complete a sale of a product with that gift card, it’s officially earned. They actually earned just $532 Million of the potential $1.3 Billion in gift cards they sold and have $840 Million just sitting there…unearned.

Peloton allows customers to buy its stationary bike for just $58 a month or its treadmill for $179 a month. The purchase requires no money down, and it has a 0% interest rate for as long as 39 months for the bike and 24 months for the treadmill. According to its S-1, they book these sales as full purchases from the moment the customer gets the equipment. Most companies do this, however they book it as in accounts receivable. Receivables sit as assets but it’s a good thing for a company to have receivables. Peloton however, chooses to book that as complete revenue. While its sales rose by $480 million in its last fiscal year, its accounts receivable rose by just $9 million. And you can be rest assured that millions of people weren't buying those bikes and treadmills straight up with cash (according to CBSMoneyWatch, about half of Peloton's exercise-equipment sales come through a financing). So they prefer to project money they haven’t earned as revenue.

This whole ordeal begs the question, what makes a business seek to claim money that that hasn't been fully earned? It’s partly a question of morality but moreso a question of business acumen. I believe every business in 2021 and beyond should work their business model toward the resemblance of having a portion or all of their revenue at risk of customer satisfaction. This might sound treacherous from a business standpoint, but some of the most notable businesses today are doing this very thing. It solves three basic problems. If everything you are paid is at risk, then:

A.) You must earn the respect of the customer.

B.) You must earn the trust of the customer.

C.) Both A and B

Even if you have a bad product, and you lose all of that revenue that ends up going back to the customer, the customer will have no choice but to respect the fact that you tried to earn their trust and respect but came up short. That’s way better than having someone complain about your business for doing the opposite. Especially on the internet where a reputation stays …forever.

A few months ago I created an account on Care.com in search for a full time babysitter. I paid a nominal fee for a three month “membership”. The problem with Care.com as is the problem with all marketplaces - nobody claims ownership of anything. The sellers aren’t held accountable for bad products/services. The buyers aren’t held accountable for being bad patrons of the product or service. The actual marketplace isn’t held accountable for nefarious sellers and buyers because they want to keep the marketplace going. So what you’re stuck with is bad (and good) actors whose morals are determined by their appetite for money.

After just a week on the platform I realized this was not the place I was going to find a reliable, trustworthy caretaker for my daughter. The reason being is because the platform extremely laissez faire. Caretakers are not bound to anyone and aren’t held accountable, they can enter into an agreement just as easily as they can exit from an agreement for any reason of their liking (usually for money). There’s really no impression of security - like if I get Uber to hail me a ride, I know I’m getting someone, who at the most rudimentary level, can drive.

From that point forward I never touched the website. However, three months had gone by and was charged a nominal fee for the next 3 months. Revenue for them. I forgot to cancel the membership. Completely on me as it clearly stated they auto-renew on the website. The issue with this is not that I lost money, but that a company who has the name care in their name doesn’t care that they’ve received money they have earned.

If you think about the best companies with customer service (Amazon, Netflix, Zappos), they do a lot of things in common. But one consensus is they never take money they haven’t earned. Amazon for instance, will refund you if you don’t like the toaster you purchased from their vendor in Idaho.

Zappos takes it to another level. According to their website, within 365 days of your purchase, you can return your items and receive a full refund.

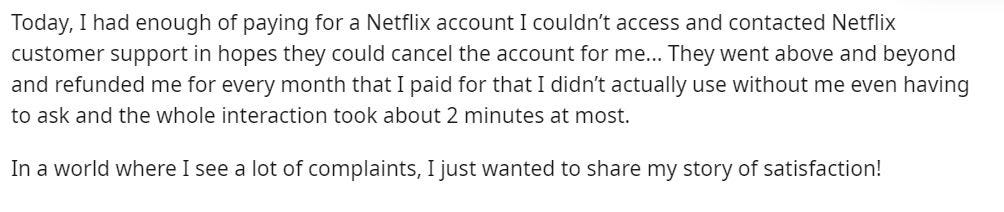

Netflix takes it even a step further. This is one of many examples you might see about them:

In a free market with consumers that have been weaponized with feedback, reviews, vlogs and blogs why on Earth would company not put their money where their reputation is? This should be a prerequisite on every business model.

100% of revenue is at risk if we didn’t not lawfully earn your business enough to:

A.) Recommend us to someone

B.) Purchase our product/service again.

C.) Both

Lastly, I do firmly believe in the future there will be a Goodwill line item in our balance sheets that measure customer satisfaction. That number could easily be used as a proxy for how fast a business is growing by:

A.) Word of Mouth

B.) Net Earned Revenue Retention

C.) Both